Overview of the organisation

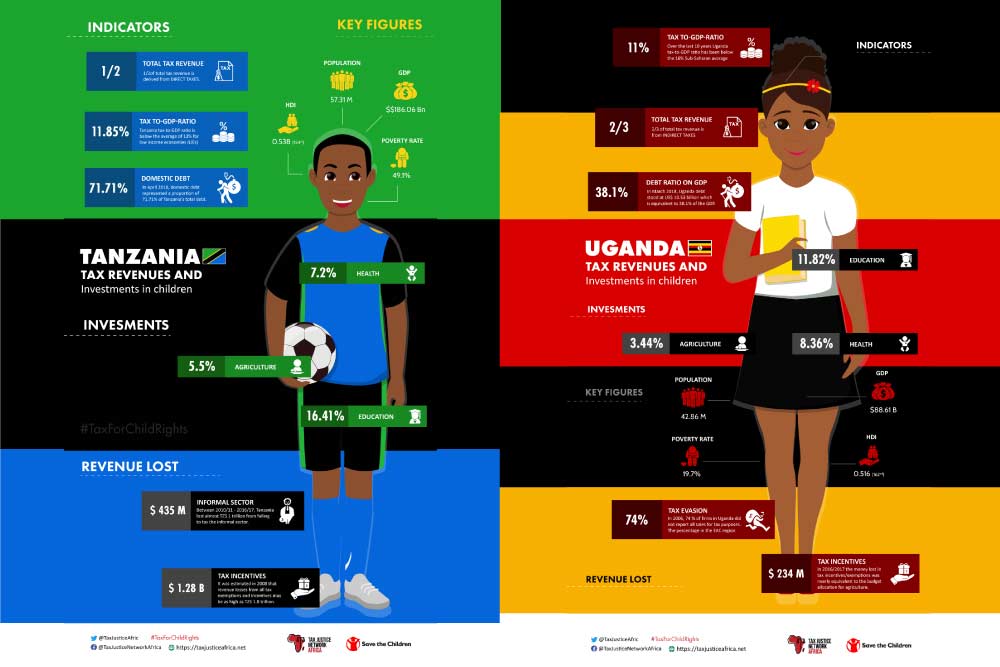

Tax Justice Network Africa (TJNA) is a Pan-African organization dedicated to promoting socially just, accountable, and progressive taxation systems across Africa. As a member of the Global Alliance for Tax Justice, TJNA advocates for tax policies that support equitable development, combat illicit financial flows, and enhance domestic resource mobilization. TJNA’s work challenges harmful tax practices that perpetuate inequality and seeks to position tax justice as a central component of the African development agenda.

Objectives of the Campaign

The primary objective of this campaign was to raise awareness about the critical link between taxation and child rights in three African countries—Tanzania, Uganda, and Zambia. The aim was to demonstrate how lost tax revenue impacts children’s health, education, and protection and to encourage public demand for accountable tax policies that invest in children’s welfare.